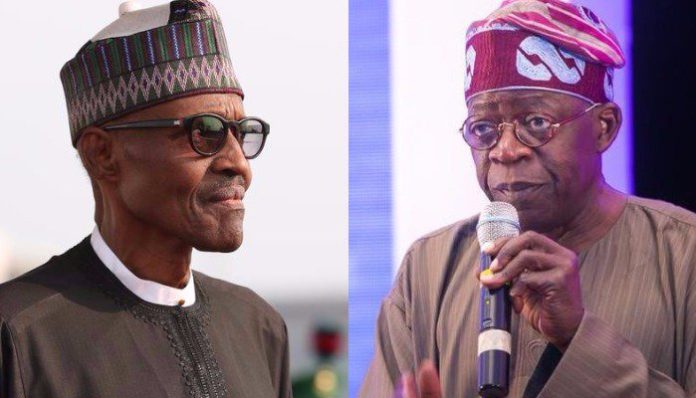

The former governor of Lagos State and national leader of the ruling All Progressives Congress, Asiwaju Bola Ahmed Tinubu, has told the Muhammadu Buhari administration to keep the Naira flowing even though the coronavirus pandemic has sharply reduced dollar inflow.

In Tinubu 68th birthday message, he said Nigeria has the sovereign right to issue its currency to stave off economic disaster, just like the U.S. government used its sovereign right to issue $2.2 trillion package to save its economy.

“While individuals, companies and even state governments can go bankrupt during hard times, the federal government cannot become naira insolvent because it has the ability to issue our national currency. He who holds the printing press is never insolvent.

“The most serious concern and limitation on federal naira spending is not insolvency but inflation. Consequently, should circumstances require increased spending, we should not hesitate to do so; but we must keep the watchful eye to ensure inflation does not climb too high.

“However to save both lives and livelihoods during a moment of historic emergency, a touch of extra inflation from enhanced government spending is a small price to pay. In fact, it is a price that must be paid.

“The alternative may be a harmful deflation which historically has proven more difficult to tame and cure than a small inflationary increase”, Tinubu said.

Tinubu and President Buhari appear to share the same idea on not reducing Naira flow amidst the pandemic.

According to Finance minister, Zainab Ahmed, President Buhari has ordered that on no account must the salaries of workers, payment of pensioners and payment for critical infrastructure projects suffer during the economic meltdown caused by the coronavirus.

Tinubu, in his message, went further to list a nine-point economic action the Buhari government could take if coronavirus mortally threatens our economy.

*MAINTAIN GOVERNMENT EXPENDITURES: The natural instinct will be to reduce spending. Such reductions may be prudent for individuals and households. For government to move in this direction only feeds economic carnage by amplifying economic hardship. Prudent fiscal policy is generally “countercyclical.” As the private sector shrinks, government does more.

At minimum, the federal government must stick to its naira budgetary expenditures. In fact, government should increase Naira expenditures by at least 10 – 15 percent during an emergency.

Allocations to state and local governments should be included in this addition. If not, we risk subnational recessions in important sections of the country.

*GOVERNMENT PROJECTS: If the virus is largely kept from becoming a widespread public health menace, government should accelerate spending and actual work on key infrastructural projects particularly regarding transportation. This will lower costs while bolstering the economy by generating employment and business activity.

If the virus does become a large-scale public health challenge, more funds should be allocated to the health sector.

* TAX REDUCTIONS: Government should announce a tax credit or partial tax reduction for companies or firms. VAT should be suspended for the next 2-4 months. This will help lower import costs and protect against shortages.

* FOOD SECURITY: We need to protect the people from food shortages and high prices. As such, we must quickly improve farm-to-market delivery of agricultural produce. Also, government should initiate a crash program to decrease spoilage of agricultural produce by construction of storage facilities in local marketplaces in and around major cities and towns throughout the country.

We must establish a strategic grain reserve. Government should help ensure supply by establishing minimum premium price for certain food products.

*LOWER INTEREST RATES: CBN should lower interest rates to spur borrowing and private sector activity.

* QUANTATIVE EASING: CBN and other financial regulators should be alert to signs of fragility in the financial markets and banking sector.

The Central Bank should be prepared to enact extraordinary measures should the financial sector exhibit stress. The CBN should be prepared to give banks liberal access to its loan discount window to ensure adequate liquidity within the banking sector. The Cash Reserve Requirement for banks should be revised downward.

Also to ensure liquidity, the CBN should be willing to expand its balance sheet and improve liquidity by purchasing government bonds and other instruments held by banks and other institutions.

The Nigerian stock market is falling. CBN and others should be planning how they might intervene to prevent a potential run on the stock market. Potential measures include expanding Quantitative Easing to enable the Central Bank to purchase strategically important instruments trading in the stock market and instituting a moratorium on margin calls.

7. EXCHANGE RATE: The Corona crisis will shrink the inflow of dollars. Hopefully, this is temporary, no more than a few months. CBN can allow some downward pressure on the naira without energetically intervening to defend the exchange rate. Only if and when the rate seems that it might dip precipitously should the CBN intervene.

The Bank may want to revisit its decision prohibiting non-institutional Nigerian dollar holders from participation in Open Market Operations. Greater leniency will bring more dollars into the CBN.

*DEBT SUSPENSION: If economic trouble does come, government must be willing to freeze payment of certain consumer-related private debts. Evictions, foreclosure and light and water cut-offs might have to be suspended. Suspension or partial reduction of payment of school fees for our most indigent families must be considered (that is when schools reopen) while government offers temporary support to the schools themselves.

*INCREASE STIPENDS TO THE POOR: We must be ready to increase stipends to the poor. We do this by widening the net, substantially increasing the number of recipients of anti-poverty stipends.

“In conclusion, I proffer these measures not as some comprehensive solution.

” I hope these ideas spark needed dialogue about the ways we may need to employ to protect our nation from assault by the coronavirus.

“I do not know if such a confrontation shall come.

“What I do know is that wise preparation will carry us close to victory.

“Unity, compassion and brave implementation of good policy will take us the rest of the way home”.

“We shall not go down. We shall rise”, he said.