•$40b foreign reserves targeted

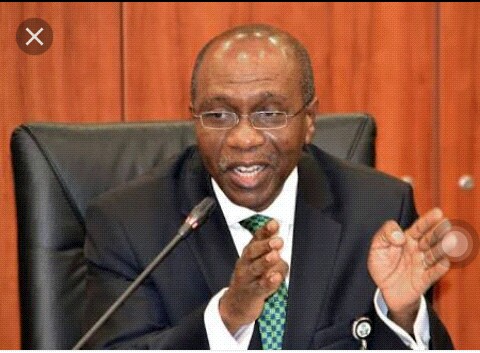

For the first time in 16 months, the Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, on Friday night, hinted on possibility of lowering interest rate in the New Year.

The CBN boss spoke at the 2017 Annual Bankers’ Dinner organised by the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos, on the positive economic outlook expected in 2018.

He explained that monetary policy stance could change in 2018 when the underlying fundamental such as drop in inflation becomes more supportive. The CBN boss did not say how low the interest rate could drop in 2018.

The CBN had at the peak of rising inflation, embarked on a cycle of tightening with Monetary Policy Rate (MPR)-the benchmark interest rate hiked in July 2016 from 12 per cent to the present 14 per cent.

“If the pace of disinflation becomes adequate and we see inflation at predicted levels, I am very optimistic that Monetary Policy Committee (MPC) may begin to see strong justification for an easing of monetary policy, which may further accelerate the recovery process,” Emefiele said.

Speaking on the theme; Policy Options for Sustaining Nigeria’s Economic Upturn, he said that from a peak of 18.72 per cent in January 2017, headline inflation recorded eight straight months of disinflation, with the rate declining to 15.98 in September.

During this period, core inflation and imported food inflation, similarly fell from 17.90 per cent and 20.95 per cent, respectively, to 12.12 per cent and 14.83 per cent.

He said the country has also seen a significant appreciation of the naira from over N500/$1 to about N360/$1. “In addition, we have seen stability in the rate for over six months now. I am glad to note that the exchange rate is not only stable, it is also converging across various windows and segments of the market,” he said.

The CBN boss disclosed that since the establishment of the Investors’ & Exporters’ Forex Window, $10 billion has been recorded in autonomous inflows through the window. This, he said, reflected the effect of the increased transparency which that window accorded the forex market and its benign impact of improving investor confidence and business sentiments.

He said that foreign reserves have recovered significantly from a low of just over $23 billion in October 2016 to over $34.3 billion as of November 3, 2017.

“The accretion in reserves does not only reflect increased inflow but also our shrewd forex demand management strategy. When we introduced a policy restricting 41 items from our forex markets, we were called all manners of names. Today ladies and gentlemen, among the benefit of that policy is the considerable decline in our import bills. From an average of about $5.5 billion, our monthly import bill has fallen consistently to $2.1 billion in 2016 and $1.9 billion by half year 2017,” he said.

According to him, the All-Share Index (ASI) and market capitalization recorded 32.10 and 32.30 per cent, respectively, to 35,504.62 and N12.24 trillion as at August 31, 2017 from the end-December 2016 levels.

Due to the dogged implementation of our forex restrictions on certain items, the CBN recorded spectacular improvements in domestic production of most of these items. Local manufacturers are reporting 20 major boosts to their revenue and profit due to the policy.

The apex bank boss said the CBN will strive to sustain the pace of recovery in the economy. He said that Nigeria’s import bill may have fallen but manufacturing and agriculture sectors still have a long way to go if we must attain self-sufficiency in those sectors.

He said forex Reserves will continue to grow. “Over the last 12 months Nigeria’s forex reserves grew by over $10 billion from just over $23 billion in October 2016 to over $33 billion in October 2017. It is my belief that if we remain resolute with our efforts, policies and actions we can attain a forex reserve position of about $40 billion by end 2018.”

On the sustenance of exchange rate stability, he explained that as the CBN entrenches and sustains the transparency in the forex market, as forex reserves accretion continues, and market confidence and improved sentiments remain, the exchange rate will not only be stable but would begin to appreciate against major currencies.

Source:The Nation