A Rivers State High Court has ruled that the Niger Delta Development Commission ( NDDC) is indebted to the Rivers State Board of Internal Revenue to the tune of N50billion for refusing legal taxes between 2012 and 2017.

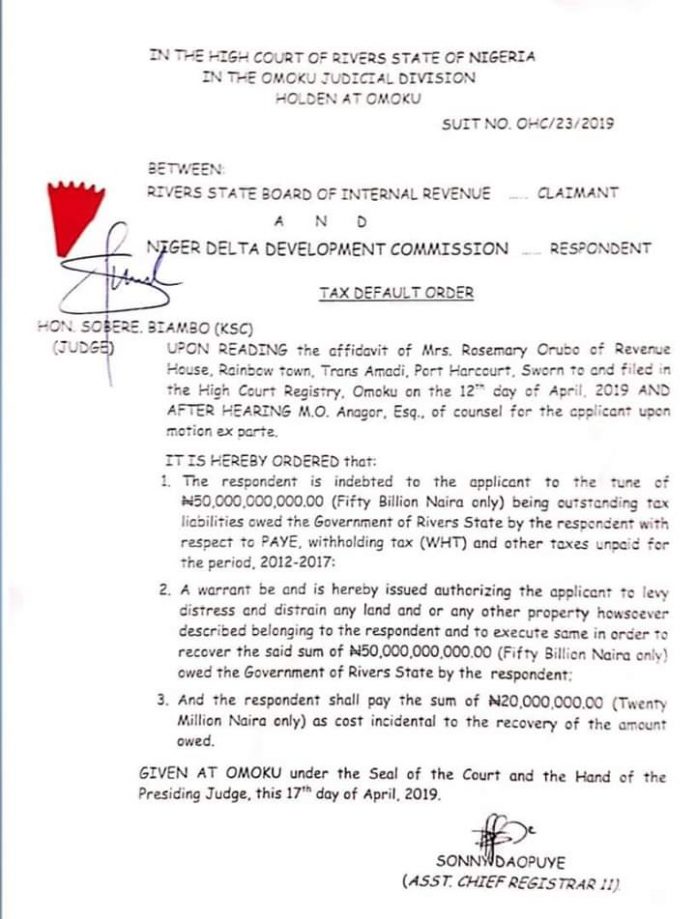

Ruling on SUIT NO. OHC/23/2019, Justice Sobere Biambo of Rivers State High Court, Omoku approved the sealing of the NDDC Office and other legal actions that will lead to the recovery of the N50billion debt.

The Court ruled: “The respondent is indebted to the applicant to the tune of N50,000,000,0000 (Fifty Billion Naira) only being outstanding tax liability owed the Government of Rivers State by the Respondent with respect to PAYE, Withholding Tax (WHT) and other taxes unpaid for the period, 2012 – 2017;

” A warrant be and is hereby issued authorizing the applicant to levy distress and distrain any land and or any other property howsoever described belonging to the respondent and to execute same in order to recover the said some of N50,000,000,000 (Fifty Billion Naira) only owed Government of Rivers State by the respondent”.

In an interview on the ruling and sealing up of NDDC, Chairman of the Rivers State Board of Internal Revenue Service, Mr Adoage Norte explained that the Revenue Agency is following due process to recover the said funds.

He argued that there is no political undertone in the move to recover the debts as all necessary actions were taken, while the NDDC has refused to respond.

Norte said: “That tax we are talking about here is not profit tax, it is not that they made profit and they should pay tax, it is not that they are given allocation and they should pay tax,this is tax they already deducted from their own staff who are working and residing in Rivers State as well as tax they deducted from contractors and vendors.

“These taxes they have collected on behalf of the Rivers state government is what we are asking for. NDDC has never opened their books, anytime you come there, they will tell you their auditor general of the federation is doing records, is doing book and all of that. Out of this frustration, we decided to send them a BOJ assessment, BOJ assessment means that since we are not able to get the assessment, I am now as a tax administrator saying I assume they are owing so much. If you know it is too much , open your record let us examine it .

“And if you are also going to object to that N50b which the law also allows you to,your objection must meet a threshold. For example, we are not owing N50b , we owe only so much and here is how we arrived at that so much. You must back it up with evidence”.